About OneSuper

OneSuper equips members with choice and a tailored superannuation offer

A tailored superannuation experience that scales benefits to members with the use of common service providers

OneSuper is a fund built on a foundation offer plus select modular options to allow sub-promoters to build a high efficiency, targeted super offering to select niche communities.

OneSuper offers a core suite of services including custody, banking, member administration, Superstream and standard member correspondence. While sub-promoters can access OneSuper’s other offerings, you are free to offer your own investment options (subject to trustee approval), member engagement and product capabilities. Please contact us to find out more.

Who is behind OneSuper

Trustee

![]()

Diversa Trustees Limited

ABN: 49 006 421 638

AFSL: 235153

Sponsor & Master Promoter

OneVue Wealth Services Pty Ltd

ABN: 70 120 380 627

AFSL: 308868

Master Administrator

OneVue Super Services Pty Ltd

ABN: 74 006 877 872

AFSL: 246883

Other Administrators

For AIA sub-plan:

Insurance and Superannuation Administration Services Pty Ltd (IASAS)

ABN: 31 058 682 876

For Integrity sub-plan:

DDH Graham Limited

ABN: 28 010 639 219

AFSL: 226319

Custodians

J.P.Morgan Nominees Australia Limited

ABN: 75 002 899 961

www.jpmorgan.com

Sandhurst Trustees Limited

ABN: 16 004 030 737

AFSL: 237906

www.sandhursttrustees.com.au

Certane CT Pty Ltd

ABN: 12 106 424 088

AFSL: 258829

www.certane.com

Key Documents

- Trust Deed

- Constitution

- Conflicts of Interest Management Policy Summary

- Directors and Executive Officers

- Directors and Executive Officers Remuneration

- Director Attendances

- Financial Report

- Privacy Policy

- Proxy Voting Policy

- Complaints Handling Policy

- Duties & Interests Register

- Material Outsource Service Providers

ABN 43 905 581 638

Passive Growth MySuper Product Dashboard

This product dashboard is to provide members with key information about Fund’s fees, risk and performance.

You can use this dashboard to compare Passive Growth MySuper with other MySuper products.

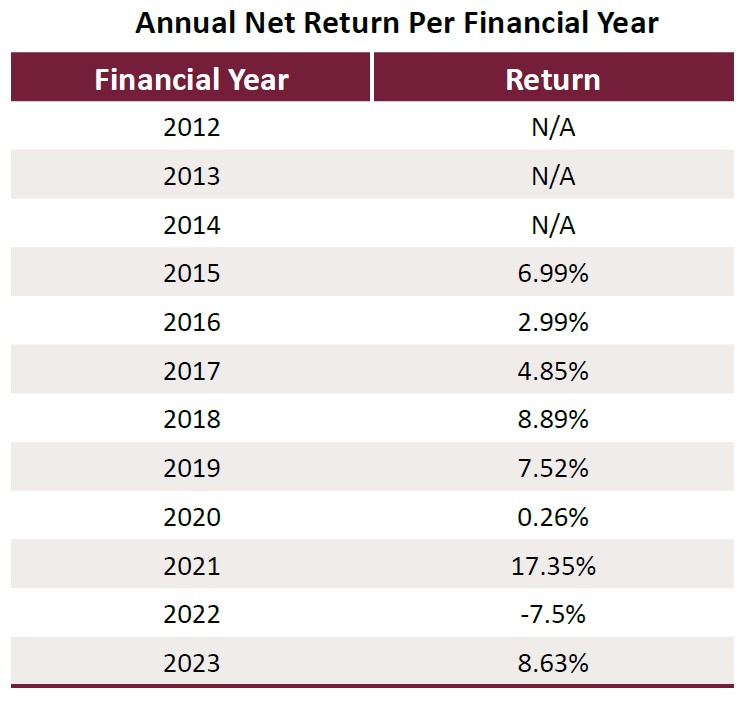

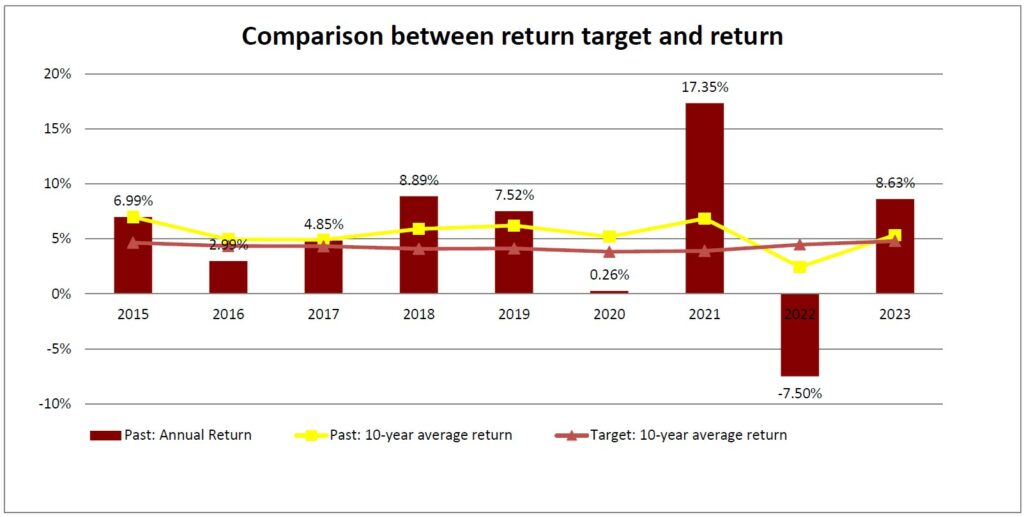

Return Target1

To provide a net return after tax and investment costs equal or better than inflation (CPI) + 2.5% p.a. for the period 2021-2030.

Return

This investment option commenced on 1 January 2014. The one year return to 30 June 2023 is 8.63% p.a.

Investment returns are not guaranteed. Past performance is not an indication of future performance.

Level of Investment Risk

High – Estimated number of negative annual returns over any 20-year period is 4 to less than 6.

Statement of Fees and Costs

$475.00

The statement of fees and other costs for a representative member who is fully invested in MySuper, who doesn’t incur any activity fees during the year and who has an account balance of $50,000 balance throughout that year. It excludes investment gains / losses on the $50,000 balance. Fees and costs reported are Administration Fees, Investment Fees and Indirect Cost Ratio.

1 The return target is calculated using a net return of a representative member. A representative member is a member who is fully invested in the investment option, who does not incur any activity fees during a year and who has an account balance of $50,000 throughout that year. Excludes: investment gains/losses on the $50,000 balance.

The fund is a superannuation product within OneSuper ABN 43 905 581 638 RSE R1001341. Diversa Trustees Limited ABN 49 006 421 638, AFSL 235153 RSE Licence L0000635 (referred to as the Trustee, we, our, us) is the Trustee of OneSuper and the product issuer. The information in this document has been prepared by OneVue Wealth Services Pty Ltd ABN 70 120 380 627, AFSL 308868 as the Promoter. It is intended to provide you with general information only and does not take into account your personal objectives, financial situation or needs. Before making any financial decisions about the fund, it is important that you read the current product disclosure statement (PDS) and Target Market Determination (TMD) and consider your particular circumstances and whether the particular financial product is right for you. The current PDS and TMD for the product is available at onesuper.com. You should consult a financial adviser if you require personal advice.

Investment returns are not guaranteed. Past performance is not an indication of future performance.